Author: Sanqing, Foresight News

On January 23, according to the latest announcement from Binance, the exchange officially launched a special airdrop event for World Liberty Financial USD (USD1) holders. This event will distribute a total of $40 million worth of World Liberty Financial (WLFI) tokens.

This event is a continuation of Binance's previous USD1 principal-guaranteed earn product activity. From December 24 last year to January 24 this year, Binance offered a 20% annualized USD1 reward for savings products up to 50,000 USD1. Influenced by the news of this event, the USD1 spot price on Binance shifted from a negative premium to a positive premium of 0.19% against USDT, currently quoted at 1.0019 USDT.

Event Period and Reward Distribution

This airdrop event lasts for four weeks, starting from January 23, 2026, and continuing until February 20. During the event period, Binance will distribute $10 million worth of WLFI tokens each week.

The first batch of rewards is expected to be distributed on February 2, covering the holdings statistics from the first week of the event. Subsequent rewards will be distributed every Friday during the event period, with the tokens being directly deposited into eligible individual spot accounts.

Participation Eligibility and Calculation Mechanism

According to the announcement, users participating in this airdrop must meet specific account asset requirements.

Eligible Account Scope: Users need to hold USD1 net assets in their Binance Spot Account, Funding Account, Margin Account, or USDⓈ-M Futures Account. Please note that USD1 held in Savings Accounts is not counted towards this airdrop statistic.

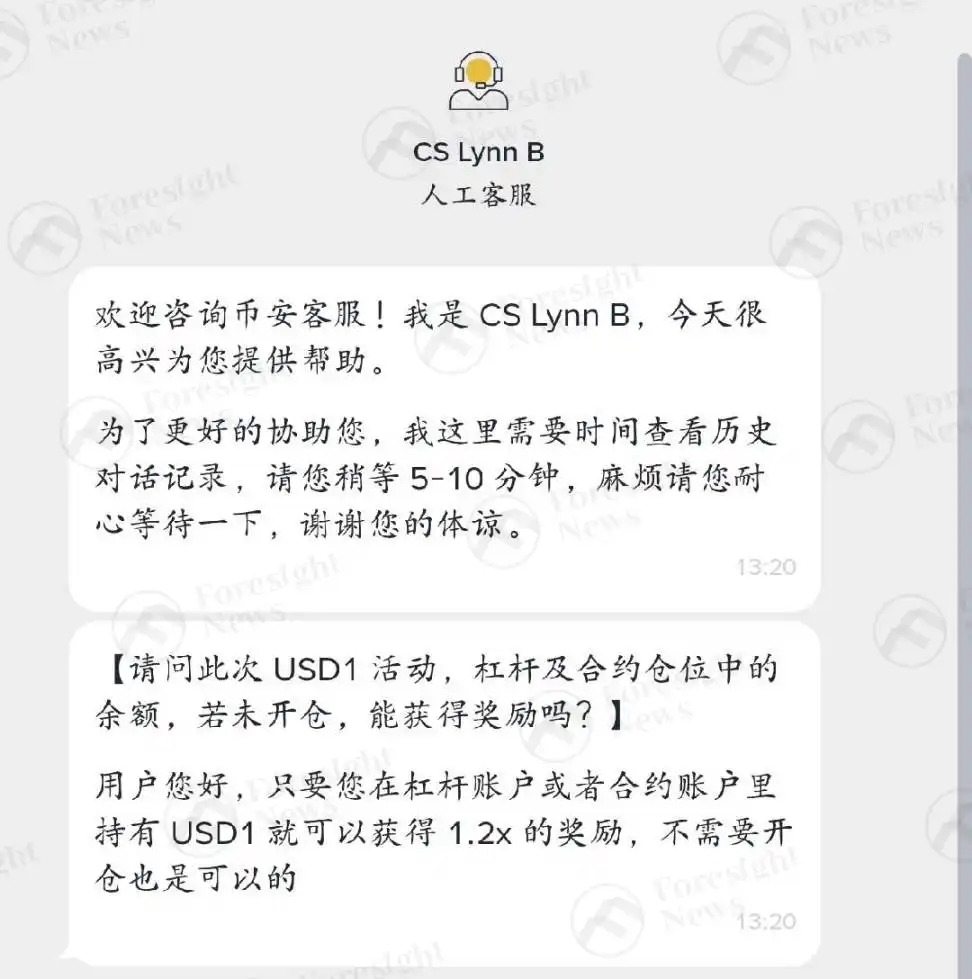

Weight Bonus: Users who use USD1 as collateral in Margin or Futures Accounts will receive a 1.2x reward multiplier. Confirmed by Binance customer service, users only need to complete the asset transfer to enjoy the bonus, with no mandatory trading (opening orders) requirement.

Figure - Binance Customer Service Reply

Calculation Standard: The system will monitor balances using multiple hourly snapshots, using the lowest snapshot balance of the day as the calculation baseline.

Net Asset Definition: Eligible balances only count USD1 net assets (i.e., holdings must deduct USD1 liabilities generated through borrowing or leverage), and the single account balance must be greater than 0.01 USD1.

Earnings Simulation

As of now, the total supply of USD1 is approximately 3.2 billion. With a weekly reward of $10 million worth of WLFI, the estimated annualized yield is calculated based on the assumed total USD1存量 on Binance (if fully participating in the event):

Annualized Yield Estimate

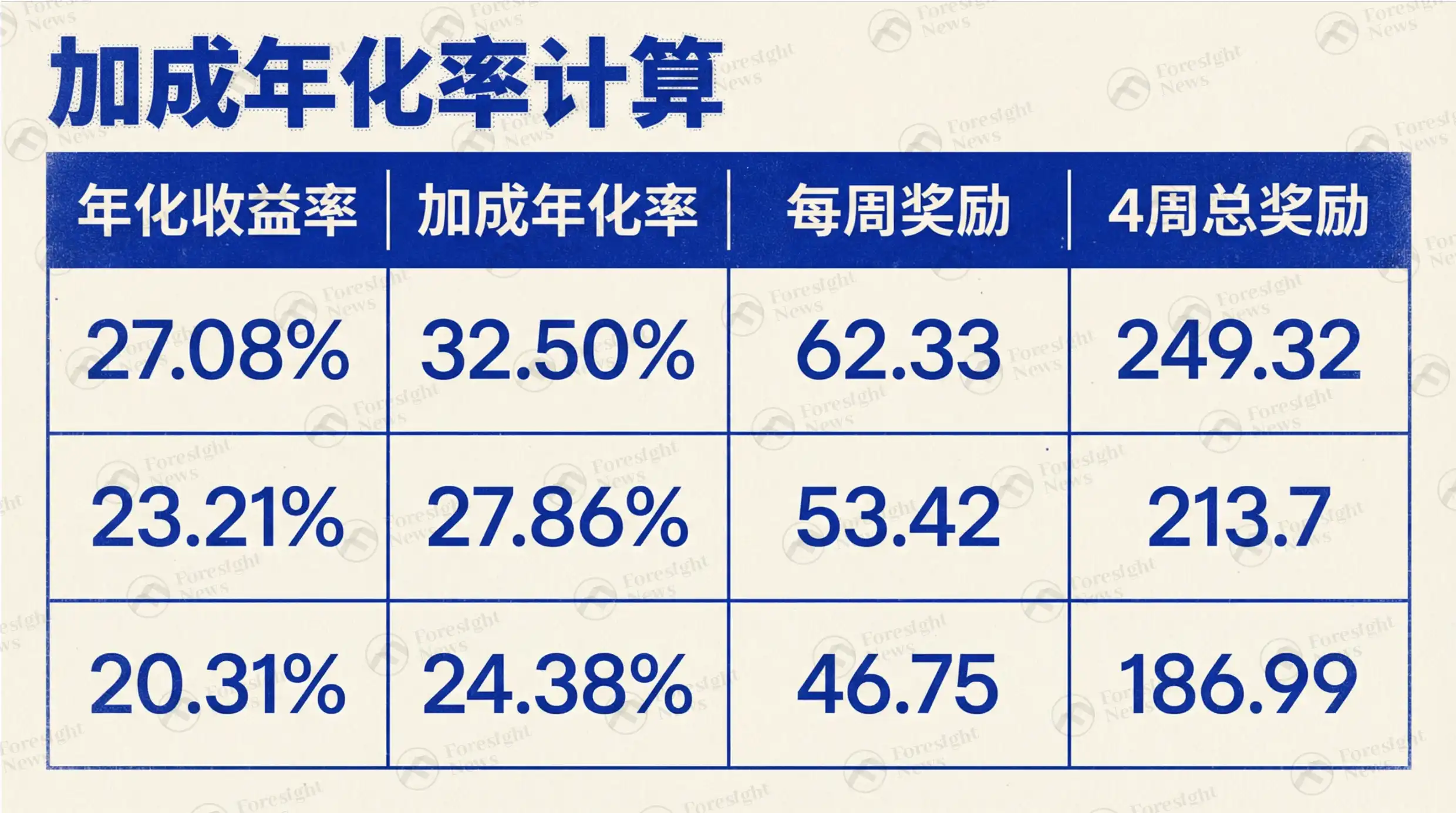

Spot & Funding Account Reward (Holding 10,000 USD1)

Margin & Futures Account Reward (Holding 10,000 USD1, with 1.2x Bonus)

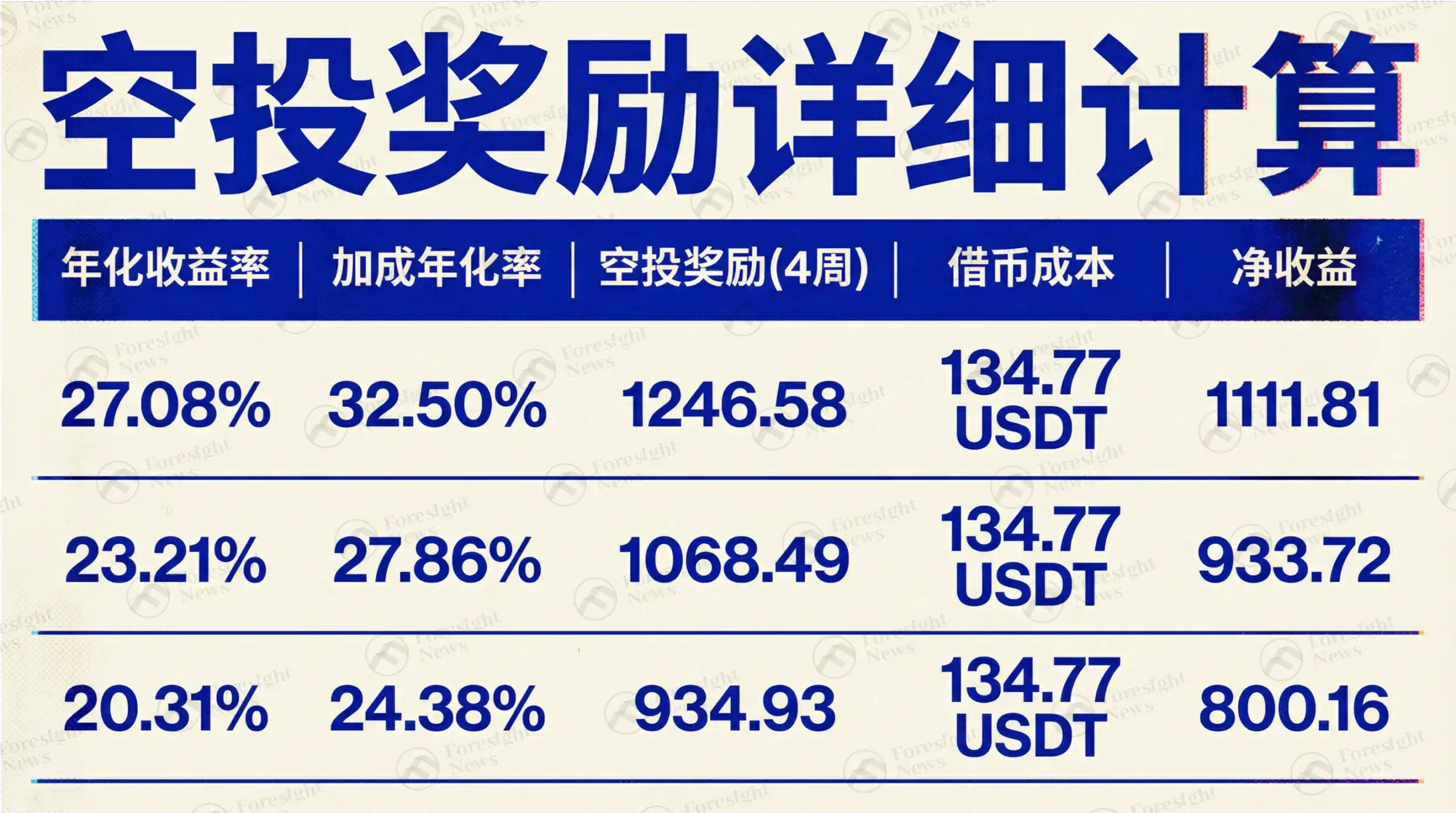

5x Margin Account Reward (Holding 10,000 USDT, using leverage to buy USD1, with 1.2x Bonus)

Note: The hourly interest rate for Binance Margin product USD1/USDT is approximately 0.0005%, the 4-week borrowing cost is estimated accordingly.

Comparison of Three Scenarios

Note: The calculation does not consider the USD1 premium. Furthermore, the total USD1 holdings on Binance are not publicly disclosed; the figures herein are estimates only.